The real estate industry is a dynamic and multifaceted sector that encompasses various activities related to the buying, selling, and management of properties. From residential homes to commercial buildings and vacant land, the real estate business plays a crucial role in the economy and society as a whole. In this comprehensive guide, Ciuc will delve into the key aspects of what is real estate business, providing you with the knowledge you need to navigate this complex field.

Exploring What is Real Estate Business: What You Need to Know

I. Definition and Scope of the Real Estate Business:

The real estate business involves the purchase, sale, and lease of properties, including land, residential homes, commercial buildings, and industrial spaces. It encompasses activities such as property development, property management, what is real estate business brokerage, and real estate investment. The scope of what is real estate business is vast, and it varies across different regions and markets.

II. Types of Real Estate:

- Residential Real Estate: Residential properties include single-family homes, condominiums, townhouses, and apartment complexes. The residential real estate market is driven by factors such as population growth, demographics, and lifestyle preferences.

- Commercial Real Estate: Commercial properties are used for business purposes and include office buildings, retail spaces, hotels, and warehouses. The commercial real estate market is influenced by economic factors, market demand, and location.

- Industrial Real Estate: Industrial properties are used for manufacturing, warehousing, and distribution purposes. These include factories, distribution centers, and industrial parks. The industrial real estate market is often tied to the performance of the manufacturing sector and logistics industry.

- Land: Land refers to undeveloped or vacant parcels of property. Land can be used for various purposes, such as residential, commercial, agricultural, or recreational development. The value of land is influenced by factors such as location, zoning regulations, and development potential.

III. Key Players in the Real Estate Business:

- What is real estate business Agents and Brokers: These professionals facilitate the buying, selling, and leasing of properties. They act as intermediaries between buyers and sellers, providing market expertise, negotiating deals, and assisting with paperwork and legal processes.

- Developers: what is real estate business developers are involved in the acquisition of land, financing, planning, and construction of properties. They oversee the entire development process, from concept to completion, and may specialize in residential, commercial, or mixed-use projects.

- Property Managers: Property managers are responsible for the day-to-day operations and maintenance of properties on behalf of owners. They handle tenant relations, rent collection, property maintenance, and ensure compliance with regulations.

- Investors: Real estate investors purchase properties with the intention of generating income or capital appreciation. They may invest in what is real estate business residential rental properties, commercial buildings, or real estate investment trusts (REITs).

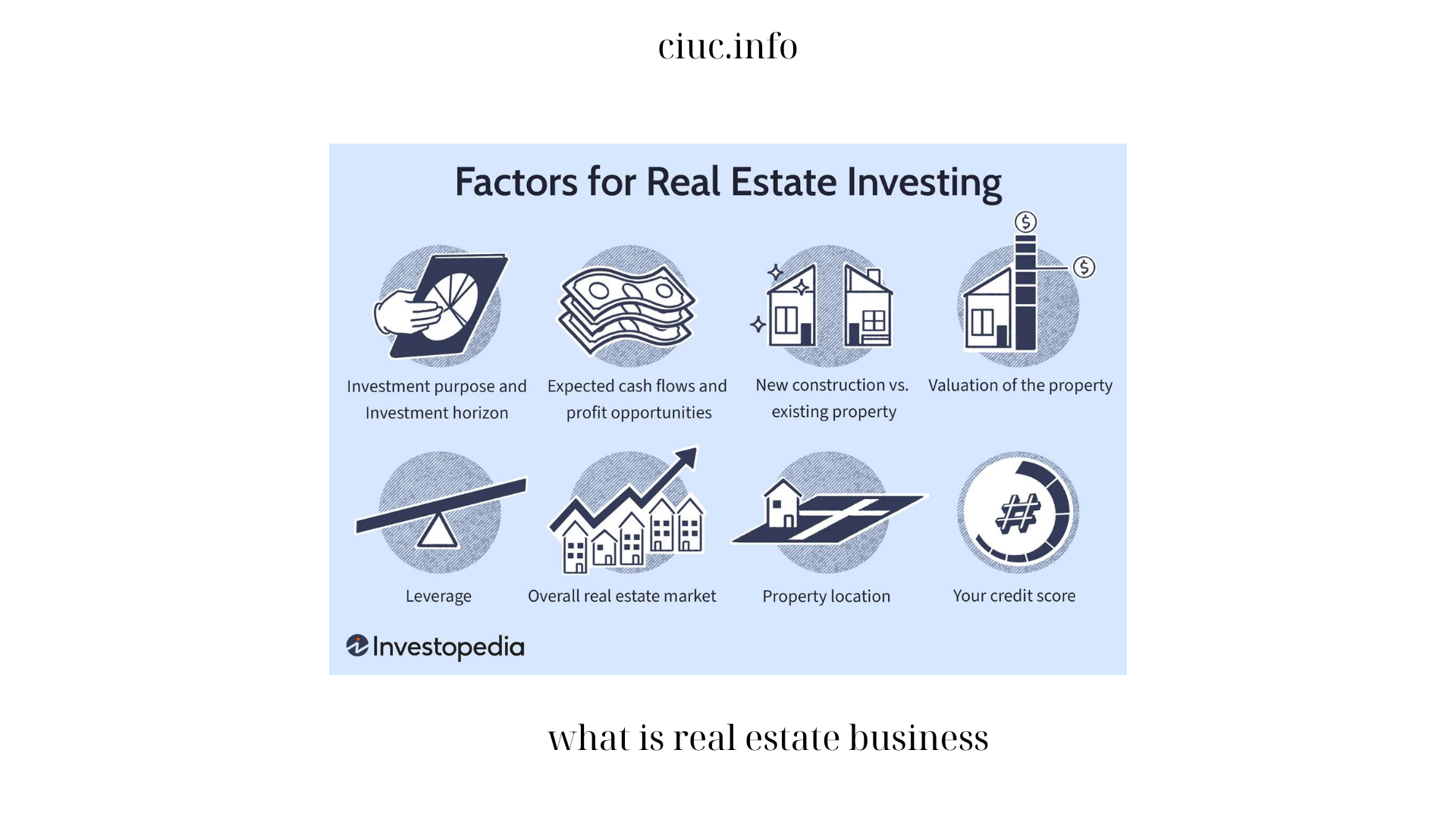

IV. Real Estate Market Dynamics:

- Supply and Demand: what is real estate business market is influenced by the balance between supply and demand. Factors such as population growth, economic conditions, and government policies impact the availability and pricing of properties.

- Market Cycles: The real estate market experiences cycles of expansion and contraction. These cycles are influenced by factors such as interest rates, economic indicators, and market sentiment. Understanding market cycles is crucial for making informed investment decisions.

- Location and Amenities: Location plays a vital role in real estate value. Desirable locations with proximity to amenities such as schools, transportation, and recreational facilities tend to command higher prices and rental rates.

- Financing and Mortgage Market: The availability and terms of financing influence the affordability and accessibility of what is real estate business. Mortgage interest rates, lending practices, and government policies impact the purchasing power of buyers and the overall market liquidity.

V. Risks and Challenges in what is real estate business:

- Market Volatility: what is real estate business market can be subject to fluctuations and volatility. Economic downturns, changes in market conditions, and unforeseen events can impact property values and investment returns.

- Regulatory and Legal Factors: what is real estate business transactions are governed by various laws, regulations, and zoning ordinances. Compliance with these regulations is essential to avoid legal issues and ensure a smooth transaction process.

- Financial Risks: Real estate investments involve financial risks, including market downturns, tenant vacancies, and unexpected maintenance or repair costs. Diligent financial analysis and risk management are crucial for mitigating these risks.

- Market Knowledge and Competition: what is real estate business is highly competitive, requiring a deep understanding of market trends, property valuations, and investment strategies. Staying informed and continuously learning is essential for success in this industry.

VI. Opportunities in what is real estate business:

- Income Generation: Real estate investments can provide a steady stream of rental income, making it an attractive option for those seeking regular cash flow.

- Portfolio Diversification: Real estate can be an effective diversification strategy for investors, offering an alternative asset class that is not directly correlated with traditional investments such as stocks and bonds.

- Property Development: Real estate development presents opportunities for creating value through property improvements, renovations, and new construction projects.