Investing in real estate can be a lucrative and rewarding venture. Whether you’re looking to generate passive income, build wealth, or diversify your investment portfolio, real estate offers numerous opportunities. However, for beginners, navigating the complexities of real estate investing can be overwhelming. In this comprehensive guide, Ciuc will provide you with step-by-step instructions on how to invest in real estate and essential information to help you get started on your real estate investment journey.

How to Invest in Real Estate: A Comprehensive Guide for Beginners

- Set Clear Investment Goals:

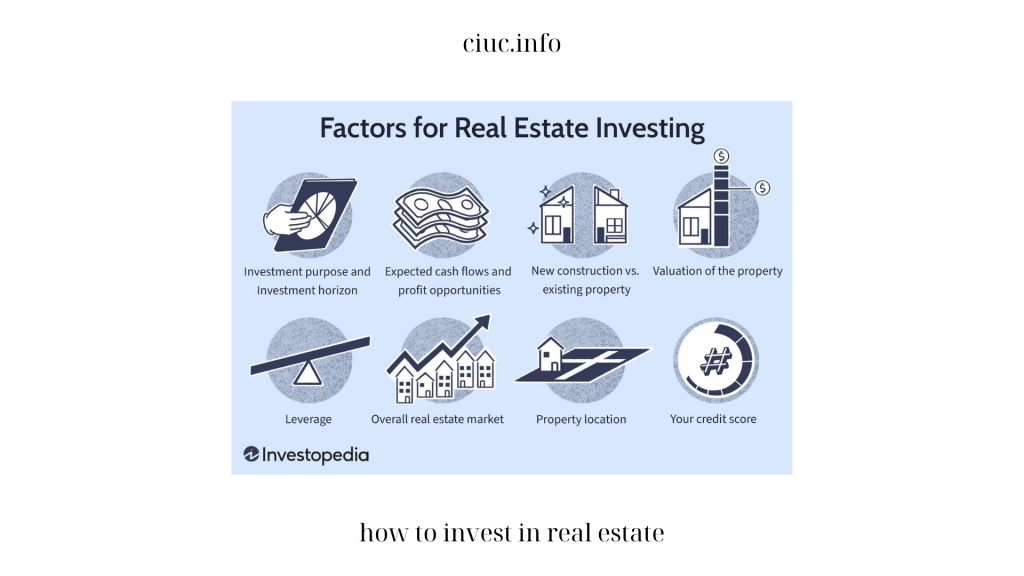

a. Determine Your Objectives: Before diving into how to invest in real estate and real estate investing, it’s crucial to define your investment goals. Are you seeking long-term appreciation, rental income, or a mix of both? Clarifying your objectives will guide your investment strategy and decision-making process.

b. Assess Your Financial Situation: Evaluate your current financial position, including how to invest in real estate your savings, credit score, and debt-to-income ratio. Understanding your financial capabilities will help you determine the type of real estate investment that aligns with your resources.

- Educate Yourself:

a. Research Real Estate Markets: Explore how to invest in real estate different real estate markets and identify areas with potential for growth and profitability. Look for factors such as job growth, population trends, and infrastructure development that can positively impact property values.

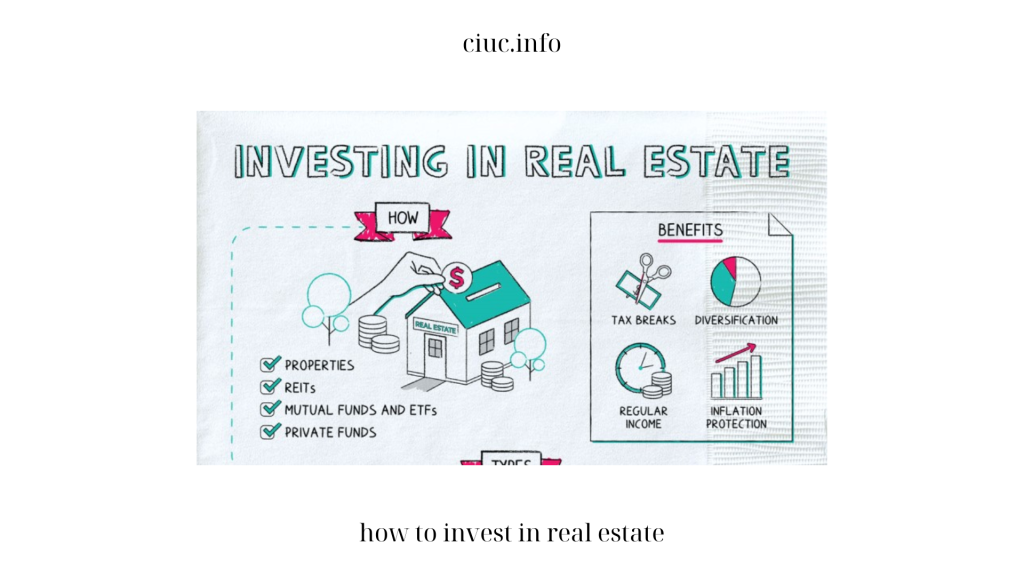

b. Understand Real Estate Investment Strategies: Familiarize how to invest in real estate yourself with various investment strategies, such as rental properties, fix-and-flip, commercial real estate, or real estate investment trusts (REITs). Each strategy has its own benefits and considerations, so choose the one that suits your goals and risk tolerance.

c. Learn the Basics of Real Estate Financing: Gain how to invest in real estate knowledge about mortgage options, interest rates, down payments, and loan terms. Understanding financing options will help you make informed decisions and negotiate favorable terms when acquiring properties.

- Build a Network of Professionals:

a. Engage with Real Estate Agents: Collaborate how to invest in real estate with experienced real estate agents who have in-depth knowledge of the local market. They can provide valuable insights, access to listings, and assist you in finding suitable investment properties.

b. Consult with Mortgage Brokers: Mortgage brokers can help you navigate how to invest in real estate the financing process and connect you with lenders offering competitive rates and terms. They can assess your financial situation and guide you towards the most appropriate loan options.

c. Seek Advice from Real Estate Attorneys: Real estate transactions involve how to invest in real estate how to invest in real estatelegal complexities. Consulting with a real estate attorney ensures that you comply with all legal requirements, understand contracts, and protect your interests throughout the investment process.

d. Consider Joining Real Estate Investment Groups: Participating in local real estate investment groups or online communities can provide networking opportunities, mentorship, and access to valuable resources. Learning from experienced investors can accelerate your learning curve and help you avoid common pitfalls.

- Conduct Thorough Market Analysis:

a. Analyze Property Prices and Trends: Evaluate property prices, rental rates, and market trends in your target area. Look for areas where property values are appreciating, rental demand is high, and vacancy rates are low.

b. Assess Cash Flow Potential: Calculate potential rental income and expenses, including mortgage payments, property taxes, insurance, maintenance costs, and property management fees. Ensure that the rental income exceeds your expenses to how to invest in real estate generate positive cash flow.

c. Evaluate Return on Investment (ROI): Consider factors such as cap rate, cash-on-cash return, and potential appreciation when assessing the ROI of a property. Compare different investment opportunities to identify the most promising options.

- Financing and Acquiring Properties:

a. Secure Financing: Based on your financial assessment and creditworthiness, approach lenders to secure financing for your real estate investment. Compare loan options, interest rates, and terms to select the most favorable option.

b. Conduct Property Inspections: Before finalizing a purchase, schedule property inspections to identify any structural or maintenance issues. A thorough inspection helps you avoid unexpected expenses and negotiate repairs or price adjustments.

c. Negotiate Purchase Price: Use your market research and property analysis to negotiate how to invest in real estate a fair purchase price. Be prepared to negotiate terms, contingencies, and closing costs to maximize your investment potential.

d. Complete Due Diligence: Perform thorough due diligence on the property, including reviewing documents, permits, and any legal or zoning restrictions. This process ensures that you have a clear understanding of the property’s condition and any potential risks involved.

- Property Management and Maintenance:

a. Decide on Self-Management or Hiring a Property Manager: Determine whether you will manage the property yourself or hire a professional property management company. Consider factors such as your availability, expertise, and the scale of your investment portfolio.

b. Establish Rental Policies and Contracts: Create comprehensive rental agreements that outline tenant responsibilities, rent collection procedures, and property maintenance expectations. Clear policies and contracts help protect your investment and ensure a positive landlord-tenant relationship.

c. Regularly Maintain the Property: Regular maintenance and timely repairs are crucial for preserving the value of your investment. Implement a proactive maintenance plan and promptly address any tenant-reported issues to minimize potential damages.

Conclusion

Investing in real estate can be a rewarding journey, providing both financialstability and wealth-building opportunities. By following this comprehensive guide for beginners on how to invest in real estate, you can navigate the world of real estate investing with confidence and make informed decisions at every step of the process. Remember to set clear investment goals, educate yourself about different strategies and financing options, build a network of professionals, conduct thorough market analysis, and carefully manage your properties. With diligence, research, and a long-term mindset, you can embark on a successful real estate investment journey and achieve your financial goals.