Real estate has long been regarded as a lucrative investment avenue, offering individuals the opportunity to generate substantial wealth. Whether you’re a seasoned investor or new to the world of real estate, understanding the various ways to make money in this industry is crucial to unlocking its profit potential. In this article, Ciuc will explore 5 ways to make money in real estate that can help you maximize your earnings in real estate and build a successful portfolio.

5 Ways to Make Money in Real Estate: Unlocking Profit Potential

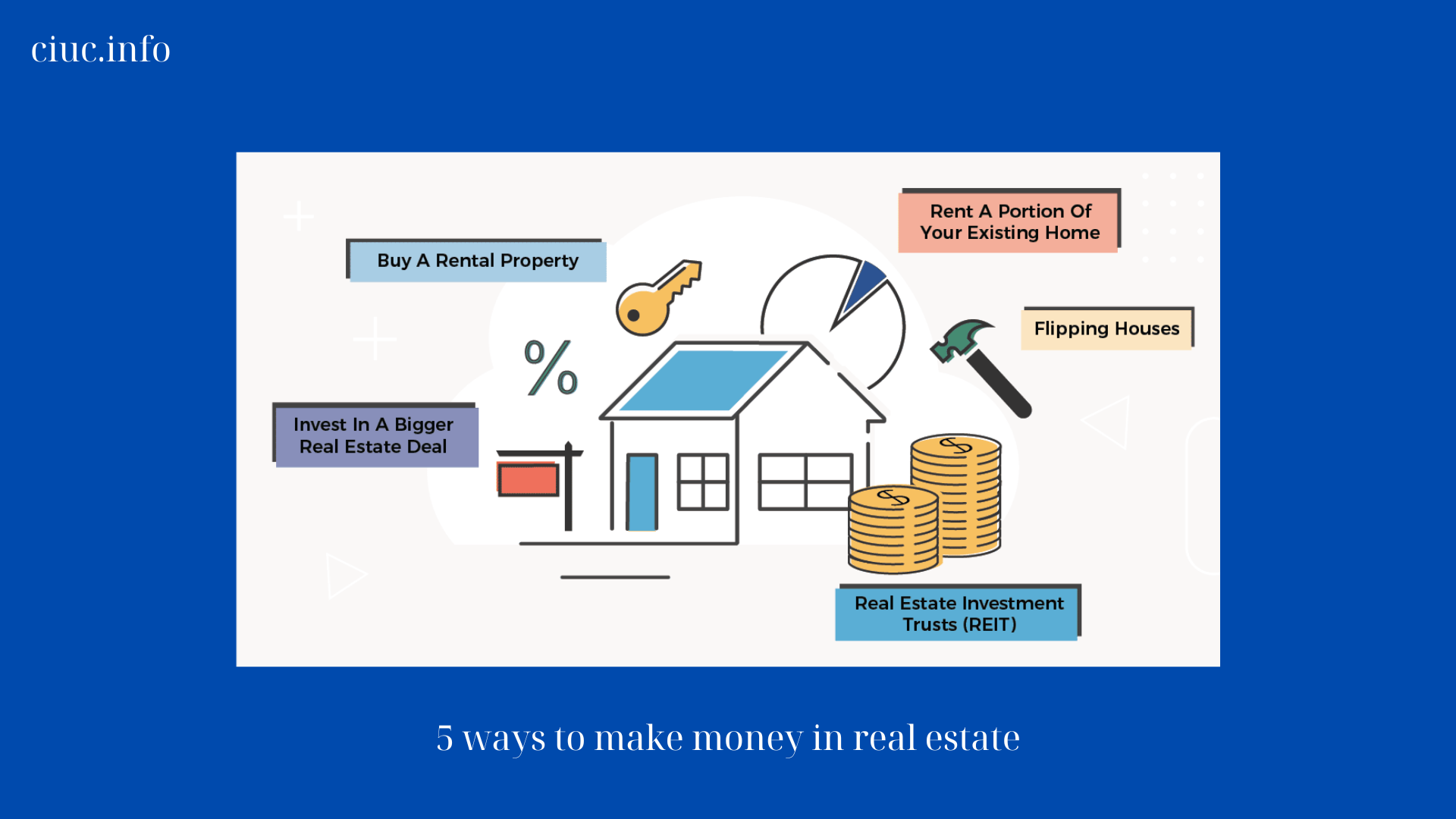

Real estate offers 5 ways to make money in real estate numerous avenues for individuals to make money and unlock substantial profit potential. Whether you choose to invest in rental properties for passive income, rely on real estate appreciation for long-term wealth accumulation, engage in fix and flip for short-term profits, invest in REITs for diversified income, or undertake real estate development for high-risk, high-reward opportunities, each strategy requires careful consideration and a thorough understanding of the market dynamics.

It’s essential to conduct thorough 5 ways to make money in real estate research, seek professional advice when needed, and develop a well-defined investment plan tailored to your goals and risk tolerance. With the right approach, real estate can be a powerful wealth-building tool that can help you achieve financial success and security in the long run.

- Rental Properties: Passive Income Stream

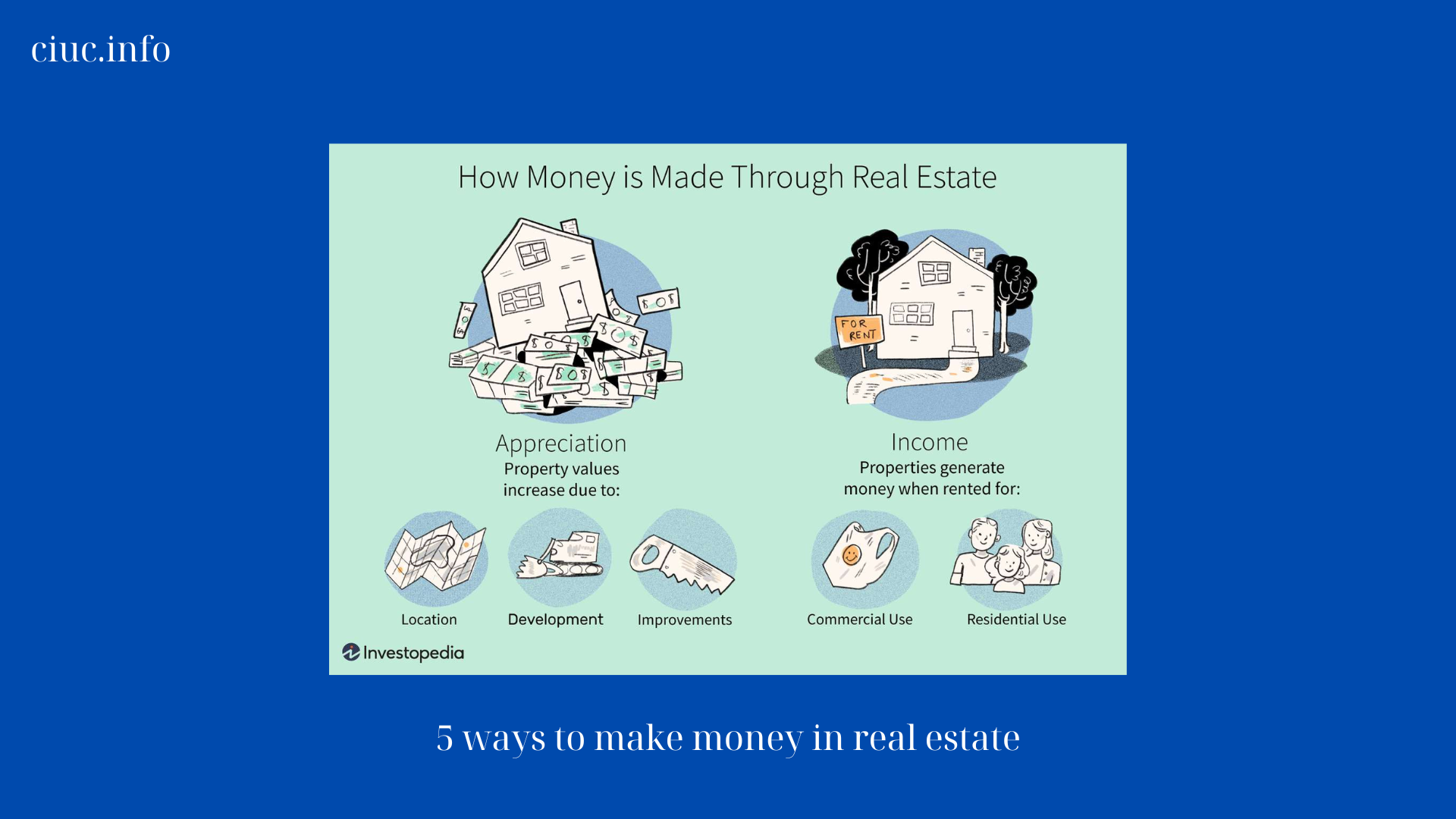

One of the most popular and reliable ways to make money in real estate is through rental properties. By purchasing residential or commercial properties and renting them out to tenants, you can generate a consistent stream of passive income. The key to success in rental properties lies in careful selection of properties in desirable locations, setting competitive rental rates, and effectively managing your tenants and property maintenance. With proper due diligence and property management, rental properties can provide a steady cash flow and long-term appreciation potential.

- Real Estate Appreciation: Long-Term Wealth Accumulation

Real estate appreciation refers to the increase in property value over time. Investing in properties with strong growth potential, such as in rapidly developing areas or neighborhoods with high demand, can lead to significant wealth accumulation through appreciation. While appreciation is not guaranteed and can be influenced by various market factors, it has historically been a reliable source of long-term wealth in real estate. Patience and a strategic approach are essential when relying on appreciation as a profit-generating strategy.

- Fix and Flip: Short-Term Profit Generation

For those seeking more immediate returns, the fix-and-flip strategy 5 ways to make money in real estate can be an attractive option. This involves purchasing distressed properties at a lower price, renovating or improving them, and then selling them quickly for a higher price. The key to success in fix and flip is identifying undervalued properties, accurately assessing renovation costs, and effectively marketing the property for a quick sale. It requires a keen eye for property potential, knowledge of the local market, and strong project management skills. While fix and flip can be a high-risk strategy, it can also yield substantial profits when executed correctly.

- Real Estate Investment Trusts (REITs): Diversified Income

Real Estate Investment Trusts (REITs) provide investors with 5 ways to make money in real estate an opportunity to participate in real estate ownership without the need for direct property ownership. REITs are companies that own, operate, or finance income-generating real estate properties. By investing in REITs, individuals can gain exposure to a diversified portfolio of real estate assets, including commercial properties, residential properties, and more. REITs offer the benefit of regular income distribution through dividends and the potential for capital appreciation. They provide a convenient and accessible way to invest in real estate while enjoying liquidity and professional management.

- Real Estate Development: High-Risk, High-Reward

Real estate development involves 5 ways to make money in real estate purchasing undeveloped land or properties with development potential and transforming them into more valuable assets through construction or redevelopment. This strategy requires substantial capital, expertise in project management, and a deep understanding of local zoning regulations and market demand. Real estate development can be highly profitable, as it allows investors to create properties that meet specific market needs and capture substantial value. However, it also carries significant risks, including construction delays, cost overruns, and market fluctuations. Successful real estate developers mitigate these risks through thorough market research, meticulous planning, and effective execution.

In conclusion, real estate offers 5 ways to make money in real estate numerous avenues for individuals to make money and unlock substantial profit potential. Whether you choose to invest in rental properties for passive income, rely on real estate appreciation for long-term wealth accumulation, engage in fix and flip for short-term profits, invest in REITs for diversified income, or undertake real estate development for high-risk, 5 ways to make money in real estate opportunities, each strategy requires careful consideration and a thorough understanding of the market dynamics.

It’s essential to conduct thorough research, seek professional advice when needed, and develop a well-defined investment plan tailored to your goals and risk tolerance. With the right approach, real estate can be a powerful wealth-building tool that can help you achieve financial success and security in the long run.